If we can't change our economic system, our number's up

Forum rules

Please read and follow this sub-forum's specific rules listed HERE, as well as our sitewide rules listed HERE.

Link to the Secret Ninja Sessions community ustream channel - info in this thread

Please read and follow this sub-forum's specific rules listed HERE, as well as our sitewide rules listed HERE.

Link to the Secret Ninja Sessions community ustream channel - info in this thread

Re: If we can't change our economic system, our number's up

uwotm8

Soundcloud

kay wrote:We kept pointing at his back and (quietly) telling people "That's M8son...."

wolf89 wrote:I really don't think I'm a music snob.

Re: If we can't change our economic system, our number's up

u cant reproduce LOL

DiegoSapiens wrote:thats so industrial

soronery wrote:New low

Re: If we can't change our economic system, our number's up

I don't want to.

I realise how selfish it is to bring a child into this life to experience inevitable suffering just for my own emotional and biological satisfaction.

I realise how selfish it is to bring a child into this life to experience inevitable suffering just for my own emotional and biological satisfaction.

Soundcloud

kay wrote:We kept pointing at his back and (quietly) telling people "That's M8son...."

wolf89 wrote:I really don't think I'm a music snob.

Re: If we can't change our economic system, our number's up

yeah but thats all gonna kick of in a couple hunnud years like u said

i reckon us n our kids are bless

this is why im not down for saving the environment or doing bare bait hippy shit... lets just admit that we done fucked it up and party like its 1999 imo

i reckon us n our kids are bless

this is why im not down for saving the environment or doing bare bait hippy shit... lets just admit that we done fucked it up and party like its 1999 imo

DiegoSapiens wrote:thats so industrial

soronery wrote:New low

Re: If we can't change our economic system, our number's up

David Banatar wrote:"It is curious that while good people go to great lengths to spare their children from suffering, few of them seem to notice that the one (and only) guaranteed way to prevent all the suffering of their children is not to bring those children into existence in the first place.”

Soundcloud

kay wrote:We kept pointing at his back and (quietly) telling people "That's M8son...."

wolf89 wrote:I really don't think I'm a music snob.

Re: If we can't change our economic system, our number's up

the last couple generations should have fun while we can tbf

not save ice or plant tress while we could be living it up

ice is just water anyway lol it will just go into the sea or evaporate... i dont get why ppl get so up in arms bout it melting. not like its gonna directly melt into your living room by some crazy teleportation or w/e

not save ice or plant tress while we could be living it up

ice is just water anyway lol it will just go into the sea or evaporate... i dont get why ppl get so up in arms bout it melting. not like its gonna directly melt into your living room by some crazy teleportation or w/e

DiegoSapiens wrote:thats so industrial

soronery wrote:New low

Re: If we can't change our economic system, our number's up

They got "too big" (there's no such thing in a free market, but in a highly regulated market with misallocated and mismanaged resources, there is) through gov. bailouts, regulation and protection.Muncey wrote:Yeah you're right, the market solution would have been to let them fail... but thats the whole point of "too big to fail".. the fact that they got so big it would have been an absolute economic disaster and highly irresponsible to let them fail.

Saying they're 'too big too fail' now is gov. propaganda. They just aren't. The consequences of letting them fail now will be dire, but they are necessary to let the market correct itself to consumer demands. Creating these political and economic limbos where you proclaim a certain company too big too fail prolongs the situation where government bureaucrats print money to inflate the money supply, or tax the poor to help the rich. Let them fail. Let the next 5 years suck so the 10 afterwards will be great, rather than have the situation worsen, tensions within society grow, the middle class decimate and throw every last right we still have at a government that doesn't care for them in return for empty promises of future stability.

They didn't do anything. This bubble was created by the Federal Reserve that was lending money at artificially low interest rates to get people to buy homes they otherwise wouldn't have bought. "Homes are a great investment! they will be worth a lot in 10 years! Just take out 3 or 4 lones, the interests are as good as zero annnnd oops..". There was nothing "free market" about it. In a free market, the interest rates would've been the product of market value and time preference.Muncey wrote:The US sort of did that, they championed the bullshit "markets work best" until they realised they clearly do not.. Greenspan has been quoted on numerous occasions admitting so. America tried to stick to their guns and left Lehman Brothers to go bankrupt and it was a disaster, they pretty quickly went "fuck that" and bailed everybody else out.

It's impossible for the current market to be "free" since America has a central bank issuing credit since the enactment of the Federal Reserve Act of 1913.

The reason why the central bank, which is a government created cartel and monopoly, can lend printed money to bankers who can then fund their own speculations, is because of government power giving the key to the printing press to the central bank and the legal tender laws that FORCE us to accept fiat currency as money.Muncey wrote:Thats a typical free market view of things. Just because people don't believe in the free market or the neoliberal farce doesn't mean they're pro-government where interactions between individuals should be controlled by a person that knows best. Its about regulating things and keeping an eye on things to stop them getting out of control. Banks, legally and illegally, operating extremely recklessly, commercial banks creating money out of thin air to fund their speculation (despite what the economics textbooks tell you), asset prices booming out of control.

In a free society, money would be the product of the market. And 99% of the time, this would be gold and silver. Sure, a bank could then also print its own money and invest it into its speculations, but if no one accepts that printed money as currency, they would be investing pieces of paper. Banks are going nuts on the speculations because the government protected central banks promise them loans regardless of results.

Well, I see many on the right, libertarians/Austrians, criticizing the, according to you "neoliberal failure' (though neoliberal is a bit of a buzword) as well. They approach the monetary system for what it is; a highly regulated one, helmed by the state. I'm fine with 'left-wingers' criticizing it, but they need to stop spreading the lie of our market being one of 'unfettered capitalism', since as I've demonstrated here, it isn't. And though I agree with the Austrian analysis, I want to see more analyses that rightfully concede that what we live is in not a free market.Muncey wrote:You can't be surprised the analysis of a right-wing neoliberal failure to be mostly left-wing just like you can't be surprised neoliberalism and neoclassical economics thrived causing huge deregulation after the failure of communism. Both have been economic disasters.

namsayin

:'0

Re: If we can't change our economic system, our number's up

I replied to all that individually and it crashed, I ain't rewriting it lol. I'll try sum up.

Basically I've not done enough research into free markets or read much of the Austrian school or Hayek but believing in the free market as a divine being to do the best is like believing in nature to do the right thing and if a tsunami hits, don't run, just stand and wave cause thats what nature wants... or that God will save Africa from an aids epidemic so leave it to him. Free markets definitely come across to me as a type of economic theism, but I'll happily admit my opinion is formed from a huge lack of information.. I'm sure free marketeers are guilty of doing the same thing.

I pretty much agreed with a lot of what you said apart from the whole money creation thing. The market would treat money as something to be determined by the market, it would treat it as a commodity... which has been proven to be bad, even viewing it like that is backwards. Money is simply trust, the trust that you can exchange whatever it is for something else in the future. Also deregulation turned the banking system into a monopoly of money.. the government isn't. It may legally control coins and notes and force us to legally to use it but as for monopoly, thats all commercial banks. Granted if we wasn't legally forced to use the money, the banks would still create normal money as its used today, if they were left to fail that trust would be gone and people would move elsewhere, I don't particularly see that as a good outcome. Its also an outcome that could work today, bitcoins are an alternative but people still trust banks.. you could probably again argue because of govrenments saving them. I still don't see it as a good outcome to leave them to fail.

I dunno how you could argue the banking system wouldn't have got so big and so powerful under free markets unless you speak extremely hypothetically and presume each bank creates its own type of currency, a failure in that bank loses trust and people move elsewhere. I completely agree that would work, is it realistic? Absolutely not. The current anti-capitalists put up alternatives that COULD work just as well, the whole 'workers ownership' could work great, is it realistic? Not at all. Free marketeers may as well be Communists in my eyes.. if your only solution is "my way or continued booms and busts" theres no difference in the two. They're fairytale alternatives to an inefficient system.

Basically I've not done enough research into free markets or read much of the Austrian school or Hayek but believing in the free market as a divine being to do the best is like believing in nature to do the right thing and if a tsunami hits, don't run, just stand and wave cause thats what nature wants... or that God will save Africa from an aids epidemic so leave it to him. Free markets definitely come across to me as a type of economic theism, but I'll happily admit my opinion is formed from a huge lack of information.. I'm sure free marketeers are guilty of doing the same thing.

I pretty much agreed with a lot of what you said apart from the whole money creation thing. The market would treat money as something to be determined by the market, it would treat it as a commodity... which has been proven to be bad, even viewing it like that is backwards. Money is simply trust, the trust that you can exchange whatever it is for something else in the future. Also deregulation turned the banking system into a monopoly of money.. the government isn't. It may legally control coins and notes and force us to legally to use it but as for monopoly, thats all commercial banks. Granted if we wasn't legally forced to use the money, the banks would still create normal money as its used today, if they were left to fail that trust would be gone and people would move elsewhere, I don't particularly see that as a good outcome. Its also an outcome that could work today, bitcoins are an alternative but people still trust banks.. you could probably again argue because of govrenments saving them. I still don't see it as a good outcome to leave them to fail.

I dunno how you could argue the banking system wouldn't have got so big and so powerful under free markets unless you speak extremely hypothetically and presume each bank creates its own type of currency, a failure in that bank loses trust and people move elsewhere. I completely agree that would work, is it realistic? Absolutely not. The current anti-capitalists put up alternatives that COULD work just as well, the whole 'workers ownership' could work great, is it realistic? Not at all. Free marketeers may as well be Communists in my eyes.. if your only solution is "my way or continued booms and busts" theres no difference in the two. They're fairytale alternatives to an inefficient system.

Last edited by Muncey on Wed Jun 04, 2014 10:28 pm, edited 1 time in total.

Re: If we can't change our economic system, our number's up

Idk why we can't just use cowrie shells. Was a great currency for hundreds of years

Paypal me $2 for a .wav of Midnight

https://soundcloud.com/artend

https://soundcloud.com/artend

Dead Rats wrote:Mate, these chaps are lads.

Re: If we can't change our economic system, our number's up

Agree the artificially low interest rates were a problem, Mark Carney is essentially creating a London housing bubble now by refusing to let interest rates rise above near 0%.Genevieve wrote:They didn't do anything. This bubble was created by the Federal Reserve that was lending money at artificially low interest rates to get people to buy homes they otherwise wouldn't have bought. "Homes are a great investment! they will be worth a lot in 10 years! Just take out 3 or 4 lones, the interests are as good as zero annnnd oops..". There was nothing "free market" about it. In a free market, the interest rates would've been the product of market value and time preference.

It's impossible for the current market to be "free" since America has a central bank issuing credit since the enactment of the Federal Reserve Act of 1913.

However it wasn't the Fed lending money too low it was the private sector. As I said before commercial banks produce around 97-98% of the money created today, private owned banks.. and they recklessly created easy credit and lent it to people who could never pay it back. It was essentially a ponzi scheme. The Fed are responsible for a lot, but issuing cheap credit is the fault of the private sector, not picking up on this and controlling it was the fault of the public.

Re: If we can't change our economic system, our number's up

That's not true, but even if it was. It doesn't matter who's printing the money, the problem is legal tender laws that are created by the state that force you to accept fiat currency as money. Whether the it's the fed or another bank.Muncey wrote:Agree the artificially low interest rates were a problem, Mark Carney is essentially creating a London housing bubble now by refusing to let interest rates rise above near 0%.Genevieve wrote:They didn't do anything. This bubble was created by the Federal Reserve that was lending money at artificially low interest rates to get people to buy homes they otherwise wouldn't have bought. "Homes are a great investment! they will be worth a lot in 10 years! Just take out 3 or 4 lones, the interests are as good as zero annnnd oops..". There was nothing "free market" about it. In a free market, the interest rates would've been the product of market value and time preference.

It's impossible for the current market to be "free" since America has a central bank issuing credit since the enactment of the Federal Reserve Act of 1913.

However it wasn't the Fed lending money too low it was the private sector. As I said before commercial banks produce around 97-98% of the money created today, private owned banks.. and they recklessly created easy credit and lent it to people who could never pay it back. It was essentially a ponzi scheme. The Fed are responsible for a lot, but issuing cheap credit is the fault of the private sector, not picking up on this and controlling it was the fault of the public.

But you may be confusing some things. The actual printing may be done by the banks (the fed does create very little legal physical money, what it does create is credit digitally. A bank or private individual could als for a wire transfer of a billion dollars, they hit a magic switch and then 'poof', the fed has a billion dollars at their disposal and it's transfered to a bank account. It doesn't need to by phyiscally printed). But banks were always in the businsess of printing; that's what banks are supposed to do historically. But they don't just can't 'literally print money' and then invest that printed money into your speculations. What these banks do before printing anything, is asking for credits, which is done digitially. And these credits are issued by the federal reserve.

The one controlling the printing presses doesn't matter. It only matters when you're talking about physical currency like gold or silver. If someone prints banknotes that are supposed to be 10 dollars worth of gold, but that gold is not there, then they're counterfeiting. But the money these banks are physically printing, if what you're saying is to be believed (and it's possible), then that money is based on fed issued credits.

It's not the physcal printing OF the money in circulation that is the culprit. It's the credit that is in rotation that is. Our worthless paper money also gets more worthless when we the federal reserve adds 000s to bank accounts

namsayin

:'0

Re: If we can't change our economic system, our number's up

Thats fair enough the actual nature of fiat money and endless supplies is a problem.. backing it with 100% reserve ratio (either backing it with gold or only lending out what they have in reserves) may be a solution but the problem then is again, you're treating it like a commodity. Having a 100% backed reserve ratio severely hinders potential.. if demand is there for credit and people are good for it, they should be allowed it regardless of whether a bank can back every single loan or not. The economy would no longer be able to fill potential demand if the banks had to have a 100% reserve ratio, its certainly the safest way about it but that's like locking yourself in a room because people before were running into the motorway and got killed.

The actual printing isn't done by the banks, thats illegal.. coins and notes anyway, thats the role of the central bank. The commercial banks just create money digitally any time a loan is made, the money supply increases by that amount.. when the person pays back that loan the money is destroyed and the money supply shrinks. This makes the money supply endogenous, not exogenous like they teach you in economics courses. Due to massive deregulation the easy credit and endless supply of money is down to commercial banks having too much power, not the fed or the bank of england. Thats actually the problem, the Fed/BoE no longer control the money supply, the private sector does.. that leads to private sector style profiteering speculation and -> financial crisis.

The fed could have done stuff about it but if you think they control the money supply you don't understand the nature of money. The only thing central banks really did was control interest rates as a method of controlling inflation, thats all they looked at... hence why they get a lot of stick because exponential-like growth of asset prices + huge rising levels of private sector debt should have been warning signs. Deregulation in the financial sector gave commercial banks power of creating credit and therefore money, taking it away for the public authorities you see as the bad guys.

The actual printing isn't done by the banks, thats illegal.. coins and notes anyway, thats the role of the central bank. The commercial banks just create money digitally any time a loan is made, the money supply increases by that amount.. when the person pays back that loan the money is destroyed and the money supply shrinks. This makes the money supply endogenous, not exogenous like they teach you in economics courses. Due to massive deregulation the easy credit and endless supply of money is down to commercial banks having too much power, not the fed or the bank of england. Thats actually the problem, the Fed/BoE no longer control the money supply, the private sector does.. that leads to private sector style profiteering speculation and -> financial crisis.

The fed could have done stuff about it but if you think they control the money supply you don't understand the nature of money. The only thing central banks really did was control interest rates as a method of controlling inflation, thats all they looked at... hence why they get a lot of stick because exponential-like growth of asset prices + huge rising levels of private sector debt should have been warning signs. Deregulation in the financial sector gave commercial banks power of creating credit and therefore money, taking it away for the public authorities you see as the bad guys.

Re: If we can't change our economic system, our number's up

This is true, but the credit in rotation is 98% created by the private sector.. commercial banks.Genevieve wrote:It's the credit that is in rotation that is.

This isn't true, necessarily. In theory it does but such an insignificant amount it isn't worth talking about.Genevieve wrote:Our worthless paper money also gets more worthless when we the federal reserve adds 000s to bank accounts

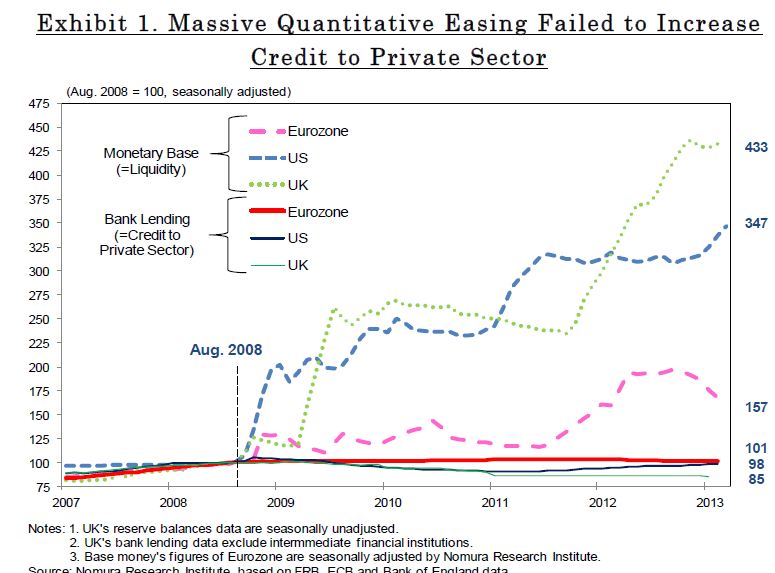

The dotted lines are what you call "when the federal reserve [or central bank] add 000s to bank accounts", the monetary base.. the solid lines are the money supply in the real economy, what you've called credit in rotation. As you can see the fed, ecb and boe have almost no effect on the money or credit in circulation.

Re: If we can't change our economic system, our number's up

"Capitalism isn't excluding anybody but it isn't doing as well by the average citizen"

Re: If we can't change our economic system, our number's up

The credit is issued by the central bank/fed as a loan to private banks that request them, they don't just control interest rates. Though the federal reserve has als used its own money printing operations to secretly bail-out like corporations.Muncey wrote:This is true, but the credit in rotation is 98% created by the private sector.. commercial banks.

But whether the fed does or doesn't do it is still a moot point. Since legal tender laws and monetary system are controlled by the state's own legislature. So calling anything any bank does "free market", even private banks, would be false. They're not operating under a free market, they're operating in a market fixed in their favor, allowing them to take risks a market wouldn't allow them to do. Who prints what is a red herring in regards to how free the economy is.

I didn't see the earlier longer post until way after responding last time and i'm going to the gym now (that and I have short attention span and tire very quickly of something). I'll try to get back to the rest asap though.

[/quote][/quote]Muncey wrote:This isn't true, necessarily. In theory it does but such an insignificant amount it isn't worth talking about.

The dotted lines are what you call "when the federal reserve [or central bank] add 000s to bank accounts", the monetary base.. the solid lines are the money supply in the real economy, what you've called credit in rotation. As you can see the fed, ecb and boe have almost no effect on the money or credit in circulation.

I meant to imply that money doesn't necessarily have to be physically printed for the currency to lose value. If money is just created and frozen on a bank account, this won't change much of the value of the currency becaus that money won't be subject to market forces. I was talking about money on bank accounts where it's intended to actually get in rotation and be spent in the economy. If someone were to draw a couple of zeros on my bank account and I went and bought things from it, this would devalue the currency.

namsayin

:'0

Re: If we can't change our economic system, our number's up

Well the private banks don't request loans in order to make loans.. far from it. Like I said private banks simply create money and credit via loans, you go into a bank, ask for a loan, they type it into your account and that money enters the market. The deregulation of banks is pretty much undisputed in terms of causing the size of the financial sector to bloat, adding that to reckless loans to people who can't pay it back (among other things) and ultimately cause the crisis. I don't think many people blame anybody other than private banks who operated under deregulated conditions. So it isnt really a moot point because you seem to be blaming the public sector like some sort of boogeyman (which it is blameable for lot) but it was the unregulated private sector. If anything the public sector is to blame for doing too little.Genevieve wrote:The credit is issued by the central bank/fed as a loan to private banks that request them, they don't just control interest rates. Though the federal reserve has als used its own money printing operations to secretly bail-out like corporations.

But whether the fed does or doesn't do it is still a moot point. Since legal tender laws and monetary system are controlled by the state's own legislature. So calling anything any bank does "free market", even private banks, would be false. They're not operating under a free market, they're operating in a market fixed in their favor, allowing them to take risks a market wouldn't allow them to do. Who prints what is a red herring in regards to how free the economy is.

I get your point about it not being completely free market but the movement towards that state certainly was the issue. I agree blaming free markets is probably very inaccurate and Austrian economists especially probably take some of the blame for absolutely no reason... but its undeniable that the deregulation and the move towards a free(er) market in the financial sector caused this. Whether becoming completely free is the answer is probably a discredited option because of that, unfairly.

As for the legal tender though its due to taxes.. you have to make a currency legal tender in order for them to pay taxes.. without it the whole public sector falls down, which I presume you want. However the whole "all or nothing" idea strikes me as a little hopeful and a bit of an extreme idea that isn't very realistic.. if all thats provided by free marketeers is "all or nothing" why should their views even be considered? Why should they be considered them more than that of a true socialist view, which is similarly optimistic if we become totally socialist?

I tend to agree with Hayek that markets are efficient but unjust.. he says that socialism is the opposite, just but inefficient. This inefficiency (lack of information, not being able to fulfill everyone's wants & needs) ultimately leads to an unjust society. I agree with that but I'd apply the same to the free market view that an efficient but unjust system will eventually lead to inefficiency due to greed, power and rising levels of "unjust".

Out of interest whats your view on child labour and bare minimum social security? Hayek thinks there should be a very bare minimum social security, I don't think many libertarians believe child labour is okay nowadays, however in the 19th century the free marketeers simply thought of it as "they want to work, people want to employ them, whats the problem?"

To what extent does a free market start to work, does it have to be entirely free for this God like system to perform its magic? At what point does the level of "unjust" make the system ineffective, if ever?

Re: If we can't change our economic system, our number's up

NY Times Op Ed - Capitalism Eating Its Children

LONDON — Guildhall at the heart of the City can be a lulling sort of place after a long day. The statuary and vaulted timber ceiling of the medieval great hall lead the eye to wander and the mind to muse on Britain’s strangest quirk — its centuries of continuity. Grace is said, claret is served, glasses clink and dreaminess sets in. A keynote speech from a central banker is all that is required to complete the soporific effect.

Or so one would think, until Mark Carney, the Canadian governor of the Bank of England, lays into unfettered capitalism. “Just as any revolution eats its children,” he says, “unchecked market fundamentalism can devour the social capital essential for the long-term dynamism of capitalism itself.”

All ideologies, he continues, are prone to extremes. Belief in the power of the market entered “the realm of faith” before the 2008 meltdown. Market economies became market societies. They were characterized by “light-touch regulation” and “the belief that bubbles cannot be identified.”

Carney pulls no punches. Big banks were too big to fail, operating in a “heads-I-win-tails-you-lose bubble.” Benchmarks were rigged for personal gain. Equity markets blatantly favored “the technologically empowered over the retail investor.” Mistrust grew — and persists.

“Prosperity requires not just investment in economic capital, but investment in social capital,” Carney argues, having defined social capital as “the links, shared values and beliefs in a society which encourage individuals not only to take responsibility for themselves and their families but also to trust each other and work collaboratively to support each other.”

A stirring through the hall, a focusing of gazes — Carney has the attention of the chief executives, bankers and investors gathered here for a conference on “Inclusive Capitalism.” His bluntness reflects the fact that, six years after the crisis, the core problem has not gone away: The deep unease and anger in developed countries about the ways globalization and technology magnify returns for the super-rich, operating in a world of low taxation and lax regulation where short-term gain becomes a guiding principle, even as societies become more unequal, offering diminished opportunities to the young, less community and a growing sense of unfairness.

Anyone seeking the source of the anger behind populist movements in Europe and the United States (and the Piketty fever) need look no further than this. Anti-immigration, anti-Europe movements won in European elections because people feel cheated, worried about their children. As Bill Clinton noted a couple of hours before Carney’s speech, the first reaction of human beings who feel “insecure and under stress” is the urge to “hang with our own kind.” And the world’s greatest challenge is defining “the terms of our interdependence.”

There is still a tendency to think politicians must do this work of definition. But in Nobody’s World, driven by social media and global corporations, corporate leaders have more power to change things than elected officials. If short-termism prevails and the importance of social capital and community is dismissed, then anger will rise. Companies are not well served by boards that are too often, in the words of one participant, “male, stale and pale.”

Carney lays out the extent of the problem: “40 percent of recent graduates in U.S. are underemployed and youth unemployment is around 50 percent in the worst affected countries in the euro area.”

His prescription: End through strict regulation and resilience tests the scandal of too-big-to-fail, where “bankers made enormous sums” and “taxpayers picked up the tab for their failures.” Recreate fair and effective markets with real transparency and make every effort — through codes of conduct and even regulatory obligations — to instill a new integrity among traders (even if social capital cannot be contractual). Curtail compensation offering large bonuses for short-term returns; end the overvaluing of the present and the discounting of the future; ensure that “where problems of performance or risk management are pervasive,” bonuses are adjusted “for whole groups of employees.”

Above all, understand that, “The answers start from recognizing that financial capitalism is not an end in itself, but a means to promote investment, innovation, growth and prosperity. Banking is fundamentally about intermediation — connecting borrowers and savers in the real economy. In the run-up to the crisis, banking became about banks not businesses; transactions not relations; counterparties not clients.”

In other words, human beings matter. An age that has seen emergence from poverty on a massive scale in the developing world has been accompanied by the spread of a new poverty (of life and of expectations) in much of the developed world. Global convergence has occurred alongside internal divergence. Interdependence is a reality, but the way it works is skewed. Clinton noted that ants, bees, termites and humans have all survived through an unusual shared characteristic: They are cooperative forms of life. But it is precisely the loss at all levels of community, of social capital, that most threatens the world’s stability and future prosperity.

nowaysj wrote: ...But the chick's panties that you drop with a keytar, marry that B.

-

test_recordings

- Posts: 5079

- Joined: Tue Mar 10, 2009 5:36 pm

- Location: LEEDS

Re: If we can't change our economic system, our number's up

Lol I read that. I wonder if it's just lip service, though sometimes UK institutions are proper socialist, like the Church of England

Getzatrhythm

Re: If we can't change our economic system, our number's up

chomsky the god

Who is online

Users browsing this forum: No registered users and 0 guests